An action plan for surviving Covid-19 financially

Oh friends, I know how hard it is right now for so many of you. I know that so many of you have seen cherished careers evaporate in front of your eyes. I know that many of you are suddenly supporting wide family networks. I know some of you have lost your retirement savings. I know that even those of you who still have jobs are anxious and scared. I wish I could wrap each one of you up in a giant hug.

It's all so horrible. This is not your fault, and please don't let anybody make you feel guilty or ashamed or like you should somehow have pre-empted this, or saved more, or taken out different insurance. The economy has been failing so many for so long, and it's not your fault if you entered this crisis with no financial safety net.

There are no easy or quick solutions here. Everyone who gives advice right now is also just guessing (including me), because none of us have been through this before. But if you're feeling overwhelmed, here's a step-by-step guide to building your own Covid-19 financial action plan.

Step 0: Take a breath

If you are on fire, and your house is also on fire, you have to put out the fire on yourself first. You are not going to be any good at firefighting until you do that.

You have to fix your mental health before you can worry about your financial health. If you're panicking, call a mental health hotline or a therapist (most of them are still seeing patients over the internet). Use technology to connect with your loved ones. Work on building a routine around exercise, and some structure in your day. Don't attempt the rest of your steps until you're feeling okay.

Step 1: Build mission control

The worse things are, the less we want to confront reality. This is the instinct you need to fight. You need a dashboard that shows you, clearly, exactly how much money you have, where it's going, and how long it will last you.

I want you to know, at a glance, what your runway is: if you lost your job tomorrow, how many months could last, living off your savings?

Here's how you calculate that:

- Add up the money you have in savings. I'm talking here about money that's easily accessible cash: so bank accounts, savings accounts, money market funds, that kind of thing. Don't count your investments, because now is the worst possible time to be selling assets. This is number A.

- Set up an app that tracks and categorises your spending automatically, if you haven't already. Work out what you're spending every month (use the average of your past few "lockdown"/"shelter-in-place" months, it's hopefully less than your usual spending). This is number B.

- Divide A by B. That's how many months of runway you have. This is the number I need you to be focusing on over the next while.

Normally, I suggest that you aim for a runway of 3-6 months. But depending on where you live, and what industry you work in, and how many other people rely on you, it might be a good idea to temporarily increase this goal.

Write down your runway goal, somewhere between 3-12 months, whatever makes sense for your personal circumstances.

If your runway is less than 3 months (it might even be a negative number, that's okay), then you also want to start listing the lines of credit you can access. Note down how much you think you can access (e.g. what's your credit card limit? How big is your access bond?) and rank them according to how expensive each line of credit is (that is, what the interest rate will be). Hopefully, you don't need to start tapping into your credit immediately, but it's helpful to have this information ready before you need it.

If you've already hit your runway goal (lucky you!) you've got two options:

- Donate the excess (more on this below).

- Invest the excess (read this article).

2. Cut the waste

Any expenses that are not adding joy, meaning or psychological comfort to your life, need to go. Now. This is not the time to be wasting cash.

Open up the app that's automatically tracking your expenses (or your bank account statement) and go through it, line-by-line. Interrogate every expense, and ask yourself:

- Do I need this?

- Could I reduce this?

Some concrete ideas:

- Negotiate a discount on any services you're under-utilizing (e.g. your car insurance) or cancel them completely.

- Shop around online for cheaper services.

What you should not do is stop paying your domestic worker or childminder, if you have one.

If you have debts, and you're not sure you'll be able to pay them next month, contact your creditors asking for debt relief. Most creditors are offering payment holidays or restructured repayment terms. But be proactive, and contact them long before your payments are due.

I've heard stories of landlords allowing rent deferrals, too. Most countries currently have a moratorium on evictions, so stand your ground if you can't afford to pay rent at all, right now.

Don't restructure your debt unless you need to, because you'll likely end up paying more interest in the long run. Remember, the longer it takes you to pay off a debt, the more expensive that debt is.

3. Diversify your income

Here's the truth, folks: nobody really knows what parts of the economy are going to be affected by this. No-one's job is 100% secure any more. If you do not have a side-hustle, now is the time to start a side-hustle.

My suggestion is to try a lot of small experiments to see what sticks. My friend Nic Harry recently published an ebook called How to Start a Side Hustle which might help. Here's an interview with him with some of the highlights.

4. Claim any money you're entitled to

This is dependent on where you are, but there might well be grants or insurance payouts you can apply for. Do your research, and make a list of anything you might be eligable for.

In South Africa, here are some options to look at:

- UIF - the employer applies for this, not the employee. If you've had to retrench a domestic worker, for instance, apply for UIF on their behalf.

- Income protection insurance - if you can't work because of the lockdown, some income protection policies will pay out, although many aren't paying out unless you actually contract Covid-19. Either way, contact whoever sold you your insurance, if you have this, and ask.

- Credit life insurance - if you have debts, there's a good chance that you have credit life insurance on them. Credit life insurance is supposed to pay off your loans if you're retrenched or if you die, but many banks are honouring claims for people who are temporarily unable to work because of coronavirus. Here's some more information about this. If you have debts, find out whether you have credit life insurance on them.

- Small business COVID-19 relief funding - the application form is here.

- SASSA grants - some more information about other SASSA grants are here.

There are dozens of global funds that have sprung up to help people in specific circumstances, so do some Googling around your unique circumstances, too. For instance, here's a roundup of relief grants for artists.

5. Support the most vulnerable

None of us can get through this alone. If the economy falls to pieces, no amount of cash or TP you've personally stockpiled is going to help you. All of us need to do what we can to support the people who are more vulnerable than we are.

Part of your COVID-19 action plan should be your personal strategy for helping others. How you can help depends on where you are, what resources you have, and on your own health (mental as well as physical)! Here are just a few ideas:

- Volunteer for your local Community Action Network / Mutual-Aid Group.

- Donate your money to emergency relief organisations - globally, you could look at the WHO/UN Solidarity Response Fund, Partners in Health or some of the others mentioned on this roundup from 80,000 Hours.

- Support the small businesses you love. This can mean buying vouchers from shops that are currently shut down, tipping delivery drivers EXTRA well, and buying art directly from artists (for instance, Bandcamp has waived their fees temporarily).

- Campaign for long-term, structural change. The world might come through this emergency more unequal, more divided, and more angry, or we might come through this better prepared to fight for climate justice and inclusive economies and the long-term sustainability of the human race. That's up to us. Strange as it seems, now is exactly the right time to be listening to activists and getting more involved in local politics, and fighting to build the kind of world we believe in.

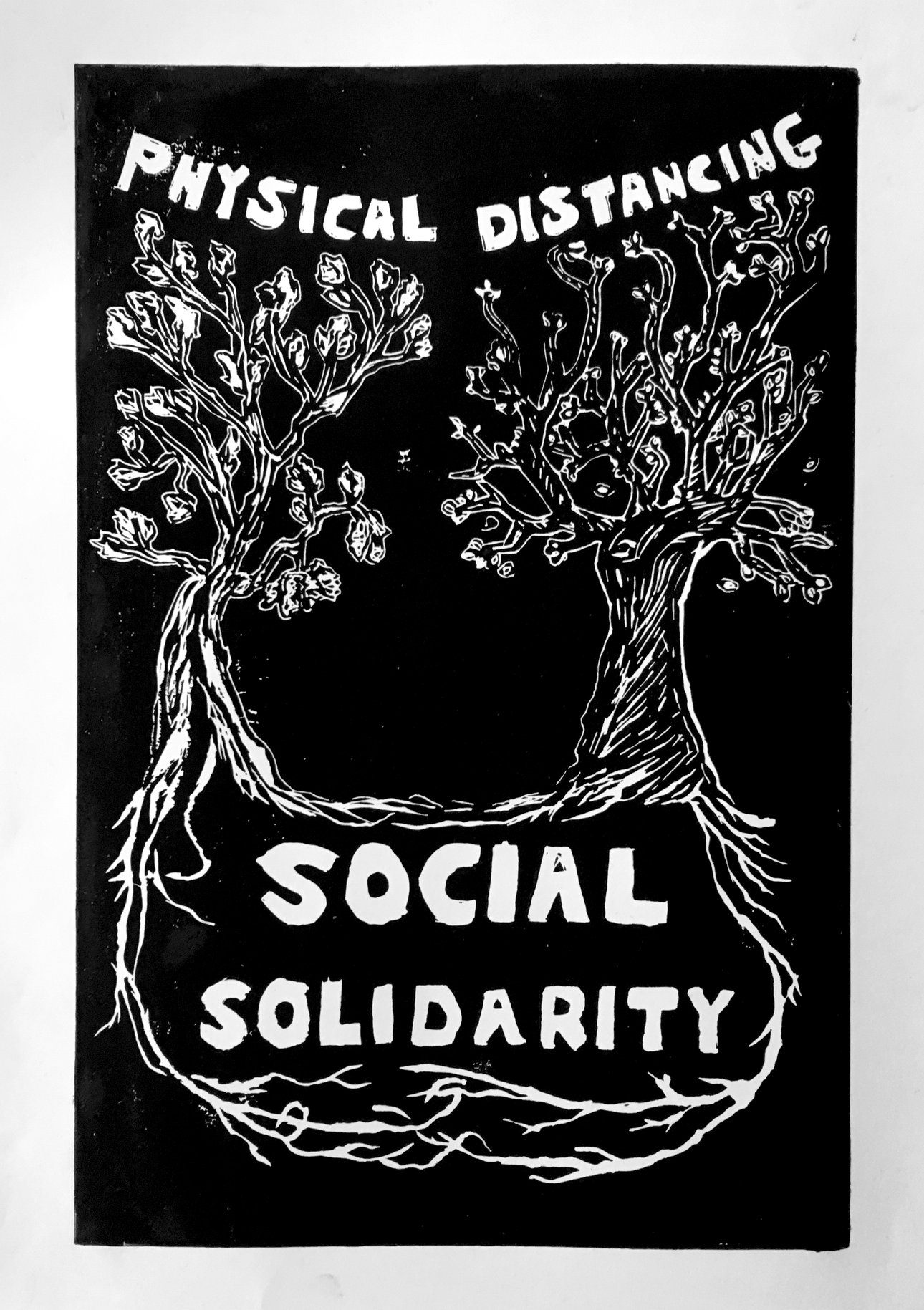

My friend Tara Weinberg made this linocut, and I love it so much. You can download a high-res version here to print out and stick up in your home, window, car or office, and Tara's raising money for Gift of the Givers.

Good luck out there, friends. I'm rooting for every single damn one of you.

Member discussion