What marshmallows can teach you about the limits of knowledge

I've been thinking a lot about the marshmallow test, recently. You know, that thing where they put a marshmallow in front of a child, and tell them that they can either eat the marshmallow now or have TWO marshmallows if they can wait 15 minutes. It's supposed to be a way to test self-control, and common wisdom is that kids who can "win" the marshmallow test by waiting 15 minutes will go on to lead far more successful lives as reliable students/responsible savers/productive employees/all-around trustworthy people/Professional Marshmallow Resistors.

Here, watch some kids trying to resist eating the marshmallow. It's HILARIOUS.

So - here's the interesting thing about the marshmallow test: it's a handy metaphor, but it's also entirely untrue.

The original marshmallow test was developed in the 1960s, with studies published in the 90s showing that the kids who could wait for the second marshmallow went on to obtain much better school and university results. The marshmallow test became common wisdom. And common wisdom with a pretty dark subtext: if you're an impulsive kid, you're probably just doomed to being a massive failure all your life, oh well, soz for you.

And then, a couple of years ago, a group of scientists tried to recreate the marshmallow test, and WHOOPS, THE WHOLE SHAKY EDIFICE OF LIES CAME CRASHING DOWN, my friends.

When they looked into the original experiment, they found two pretty huge flaws in how it had been designed:

- The experiment had been run on fewer than 100 kids.

- All of those kids were from exactly the same (rich, white, American) background.

So they replicated the experiment, except properly this time, and hey, two fun facts emerge:

- Actually whether you can resist a marshmallow for an extra minute when you're four years old doesn't accurately predict achievement across your whole damn life, because OH HEY WHO KNEW humans are dynamic and complicated and change and grow over their lifetimes.

- Most of the variation in whether kids can wait for the second marshmallow or not comes down to the family background and home environment. In other words, it's easier for rich/privileged kids to wait for a second marshmallow. And that was actually the factor that had most of the influence over their ultimate life outcomes, rather than some inherent trait like "grit" or "impulse control".

It's that second fact that really tickles me. Because I'm somebody who talks to people about money for a living, including, yes, explaining to people that saving/investing your marshmallows can be much more beneficial in the long run than eating them all now.

But the thing that the marshmallow test reminds us is how much knowledge is contextual. Most of the kids in the experiment who were eating the marshmallow, instead of waiting, were behaving reasonably and in line with their experience of how the world works. If everything you've experienced about your first four years on the planet indicates that there probably WON'T be any future marshmallows, then of COURSE you're going to eat the one in front of you, right now. That's what your life experiences up until that point have taught you to do.

We think of knowledge as stable, objective. Rules carved into stone tablets. And sure, some of it is. Hydrogen Peroxide and Potassium Iodide react the same way (awesomely) no matter who you are and where you come from.

But a lot of the rules you know aren't carved in stone. They're more like rules in a game you're playing with a bunch of other people, that rely on the other players continuing to play by the same rules as you are. Social knowledge is mostly contextual. What you believe about the right way to behave is so dependent on your life experiences. And people's life experiences are remarkably diverse.

And it turns out that the rules of money are much more like social knowledge than like the rules in chemistry.

In the world of personal finance, when I encourage people to save and invest their money, there are 100 assumptions that underpin this advice. I assume that you live in a world where the economy is fairly stable and the value of investments or savings accounts are likely to increase over time. I'm also assuming that saving money in the first place is even possible for you, that investments are safe and banks won't steal your money. And the inconvenient truth is that this isn't always true for everybody, everywhere, at all times. I have friends from Zimbabwe who saw their investments become worthless because of hyperinflation. Savers in Lebanon are going through this right now. What advice would I have for people in those situations? I have no idea.

There are contexts where all of the normal advice collapses. Times of crisis where trying to follow the rules of the old world will only make things worse for you.

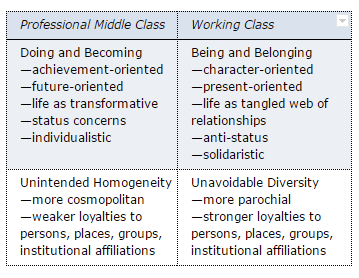

There's a whole line of research into how people from different social classes develop different cultures. We develop different perspectives on a bunch of things, from our attitude to work (a way to put bread on the table, your entire identity, how success is measured, an optional inconvenience that's a bit gauche to talk about really) to how important we think it is that young people move out of the family home in their early 20s (a crucial milestone, unlikely, it would be an antisocial and weird thing to do). None of these ideas are inherently right or wrong. They are ideas that make sense in their context.

Part of why I'm so fascinated by money is because I grew up moving between social classes. My parents were the first ones in their families who made it out of the working class into the middle class, but only just. We could afford to buy a house and car and medical aid, but we were always exactly one financial disaster away from losing it all. A lot of our lifestyle was funded by credit card debt and my parents had no tertiary education and woefully insufficient retirement savings. Economists call this the "vulnerable middle class" as distinct from the "stable/professional middle class".

But my nuclear family had much more than the rest of my extended family, who were solidly working class, lived on state pensions and went to public hospitals. My parents were fiercely proud and believed there was deep shame in having financial troubles, as opposed to my wider family who lived in porous multigenerational households and had much stronger expectations of helping each other out in tough times. They were living in worlds that had different rules.

And then, in high school, I got a scholarship, and started going to school with rich kids, and learned about the existence of things like "family trusts" and "share portfolios" and "holiday homes" (some families just own A WHOLE OTHER SPARE HOUSE, my dudes, I kid you not). Rich kids have entirely different rules and expectations for their lives. Of course they do; it's rational for them to do so. And you can't, I'm afraid, become rich just by following their rules, because they only work in the context they come from. Take - for instance - how totally relaxed my rich (white) friends were about breaking the law in harmless ways (pot, bunking school, trespassing), because it was entirely implausible to them that there would be any terrible consequences for them if they were caught. Unfortunately, acting with that same level of entitlement if you're not actually rich and privileged is just dangerous.

I am someone who talks to people about money for a living, and even I don't talk about this enough: so much financial advice is contextual and classist.

One of the things I say often is that everyone should have an emergency fund. But even this is a piece of contextual advice. Most working class people don't have an emergency fund, but they have a family who will support them if they need it. Why is that necessarily worse than having a pile of money sitting in the bank? Maybe it's more accurate to say that everyone needs to have emergency resources, but this can be a mix of things: strong family ties, a family home you can move back to if you need to, a family business that can employ you if you lose your job, cash, burial societies, insurance, a line of credit, AND whatever else you need to get through tough times.

The money culture that you grew up in will shape you throughout your life. Sometimes, growth means recognising when you're still trying to play by rules that don't apply to your life any more. Rules that once served you, that no longer do.

I'm grateful for all the times in my life that I've been confronted with how little I actually know about anything. How the world is so much bigger and stranger and more interesting than I know. How, as soon as you step into a new context, the rules change.

It's part of what's been extremely fun about being in a whole new country: I'm suddenly an idiot. I'm blundering around in the world like an alien trying to pilot a human-suit for the first time. Small children know more than me about how to do ordinary things like use the self-service checkout machine (it's a bleeping devil robot and I do not trust it). I went from feeling like somebody who's Mostly Got Her Shit Figured Out to somebody who can't remember her own phone number or understand old people when they talk.

It's terrifying! It's exhilarating! It's an opportunity to take all of the things I think I understand about how the world is and reconsider them, to rebuild my own sense of the rules that define and confine my world.

I hope that whatever you're going through right now, it's a chance to let go of rules you don't need any more.

Wishing you infinity marshmallows,

Your friend Sam.

Updates from Sam-Land

I had the most lovely conversation with one of my favourite people in publishing, @arthurattwell, about marketing books and the power of creative collaboration. And you can listen to our chat right here.

Member discussion