Some great apps and tools to help you manage your money

Last updated: July 2025

You can't manage what you can't see. If your money habits are based on vibes and vague guesses, it's time for a change.

To build good financial habits, you need an app that shows you three things:

- A clear view of all your recent transactions (so you can see where your money's really going)

- A snapshot of your current balances (bank accounts, investments, debts, savings)

- A system that keeps this data up to date without stealing your entire weekend (ideally, by automatically syncing the data securely with your financial institutions)

Some people like a spreadsheet (I’ve even made one for you to download here). Others prefer an app that does the heavy lifting. You do you. Either way, you need a way to see your money clearly.

But here’s the thing: most “Best Money App” lists are written like the rest of the world outside of the United States doesn’t exist. Mint? Monarch Money? Rocket Money? Quicken? Great if you live in Delaware. Much less useful if you're sitting in Durban, Delhi, or Durham.

So I’ve made you a better list. Whether you’re in South Africa, the UK, or with pots of money all over the world like a wanderlust leprechaun, these apps actually work for you.

🌍 Best global apps

All of these apps work globally and let you track accounts from anywhere in the world (great if you've ended up with pockets of money in different countries). They all offer manual entry if you prefer to update your data yourself. The main difference is how well they support automatic syncing with banks and investment platforms from different countries.

I’ve indicated how well each platform covers South African institutions specifically (I'm South African), but even if the auto-sync isn't available for your country, you can still use any of these apps by entering the data manually.

|

App |

Key Features |

$/month |

SA auto-sync |

|---|---|---|---|

|

Spending & wealth tracking • Clean UI |

$9 |

Good | |

|

Spending & wealth tracking • Rules engine, clean UI, great team |

$10 |

None | |

|

Spending tracking only • Good-looking mobile and web apps |

Free |

None | |

|

Wealth tracking only • Great advanced investing tools |

$20 |

Excellent | |

|

Spending & wealth tracking • Klunky but full-featured |

$10 |

Good | |

|

Spending & wealth tracking • Pretty |

Free / from $10 |

Good | |

|

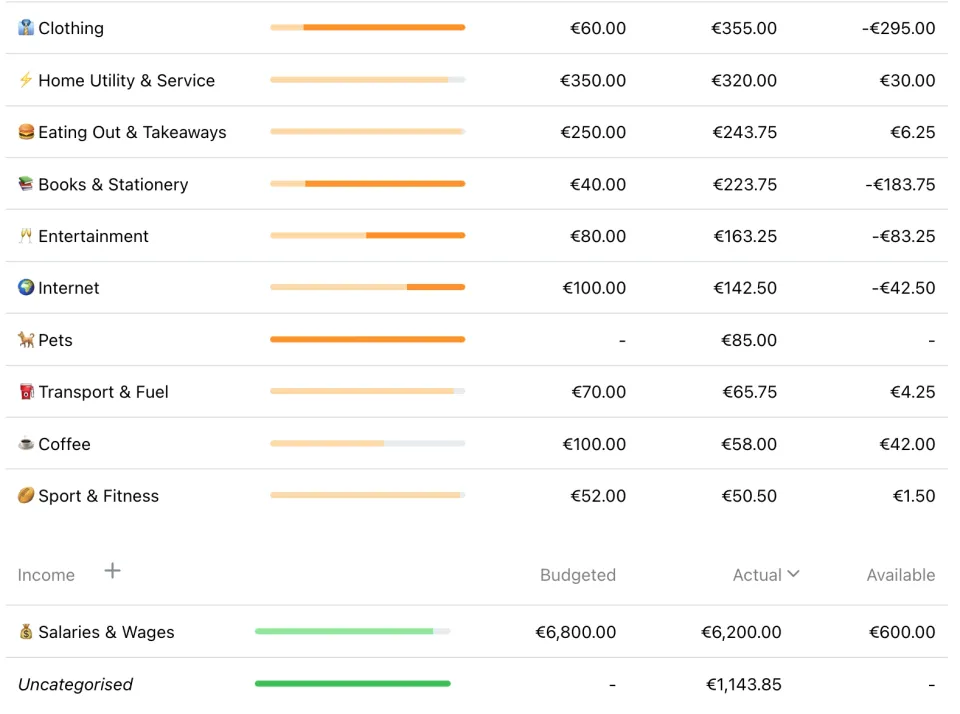

Budgeting only • Strict budgeting philosophy you’ll love/hate |

$15 |

None | |

|

Spending tracking only • Minimalist |

Free / from $3 |

Limited | |

|

Spending tracking only • Stylish UI |

Free / from $2 |

Limited | |

|

Spending tracking only • Needs tech savvy, but great privacy |

Free |

None | |

|

Wealth tracking only • Investment-focussed |

Free / from $10 |

Limited |

🥇 My favourites are Finwise and Lunch Money, but take a look and see which one will be best for your individual needs.

If you're looking for more advanced wealth management tools, I personally use Kubera and love it to bits.

🇿🇦 Best South African apps

Tjommas, the best option right now is Finwise, which costs about R150 a month. It's a global app but built by two South Africans, with excellent coverage of local banks and investment platforms. Privacy, check, security, check. It's the best all-rounder at the moment. Or take a look at Lunch Money if you're happy to upload your bank transactions once a month.

The other global options listed above also work in South Africa. Sadly, auto-sync coverage of South African banks is spotty (for instance, Spendee only covers FNB). Kubera has the best coverage across Sub-Saharan Africa overall, for instance they offer Standard Bank, FNB, Nedbank Eswatini, ABSA Ghana etc., but Kubera is more of a wealth-management app than a spending tracker. Buxfer and Pocketsmith support most major South African banks. If you're willing to use CSV uploads, you can use basically any tool from the Global Apps list.

Your best free South African-only option is Vault22 (which used to be 22seven). It's fine, and backed by Old Mutual. Something I'd suggest: you can turn off third-party data sharing in the Settings, which stops the app from sharing your information amongst the wider Old Mutual group and their affiliates. I highly recommend you do this.

Most regular banking apps offer day-to-day budgeting these days (Capitec's and Discovery Bank's are both pretty good), but you can’t keep track of other things (like your investments or debts) with them. They're not a bad place to start.

Other useful South African money apps

- Clearscore: check your credit score, for free.

- EasyEquities: Sam's fave South African investment platform. Other options are Franc (good but they don't offer global funds) and OUTvest.

- Splitwise: an app to help you keep track of money that your friends and family owe you. Very useful if you’re sharing expenses amongst a whole group of friends, like on a holiday.

- Price Check: before you buy something, quickly check whether there’s another store that’s selling it for cheaper. The app has a barcode scanner so you can search for stuff really easily when you’re in the shop.

- Luno: the easiest place to buy and sell cryptocurrencies in South Africa, if you’re into that.

- Naked Insurance: affordable, transparent household and car insurance.

- Shyft: an app that lets you buy, store and send foreign currency more simply.

- TaxTim: makes doing your tax return a little bit simpler.

- Karri: an easy way to manage small payments to your kid’s school.

- Mama Money: a cheap and easy way to send cash to other countries in Africa.

🇬🇧 Best apps for the United Kingdom

Open Banking is the shit, guys! Luckily for you, this means that you have lots to choose from when it comes to spending trackers.

Great UK-centric apps to help you wrangle and track your spending

- MoneyHub: a brilliant aggregator and budget tool available on web and mobile

- Snoop: savings nudges and budgeting tools

- Emma: smart insights about your spending.

- Cleo: a chat-based AI that will help you budget, save and track your spending.

For spending trackers, try any of the apps listed under "Global" above. I also really love Emma and Snoop.

A lot of banking-ish apps (like Monzo's and Revolut's) allow you to track some other savings and investments directly in your transactional app.

UK apps for investing and saving

- Hargreaves Lansdown: the #1 UK investing platform; a great place to start for most people.

- Chip: an app that helps you save for goals.

- Plum: a simple chatbot style investment app that has some cute money management features in it too. Good for beginners.

- InteractiveInvestor: a full-featured investment platform.

- NuWealth: a simple app for effortless investing.

- Freetrade: simple interface and quick setup.

- Nutmeg: offers a bit more guidance than the rest.

- Wealthify: risk-based investments backed by Aviva.

- Wealthsimple: simple guided investments with smarts.

Personally, I invest directly through Vanguard.

Member discussion