10 ways to inflation-proof your budget (tips from an AI)

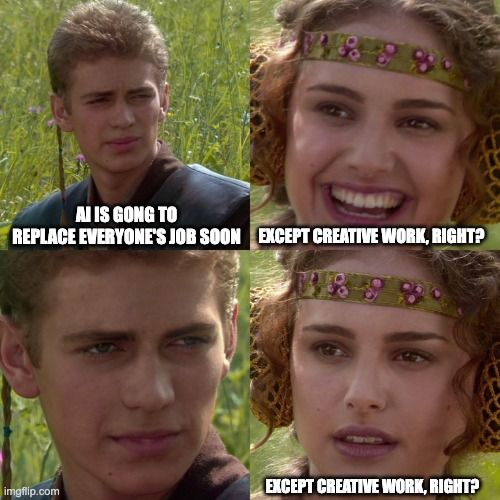

I've been fascinated to see how quickly artificial intelligence (AI) tools for creative work have entered the mainstream. Did you know that AI can now generate memes for you? Social media posts? Even... entire blog posts?

I'm a lazy possum who dreams of never having to do any work, so I asked an AI to write this blog post for me (specifically, I used Neuro-Flash AI Writer for this, but there are loads on the market). I'm hoping it will be so good that I can spend the rest of the day playing Uno with my cat. Let's see.

Okay AI, take it away!

(This whole article was written by an AI and I do not stand by any of these tips.)

Inflation in the UK is currently at its highest level in five years, meaning that the cost of living is rising faster than wages. This can be a struggle for many people, particularly those on low incomes.

If you’re looking for practical ways to start saving money now, the following tips can help:

1. Review your budget regularly

It’s important to keep on top of your finances and budget regularly, in order to ensure that you are not overspending. This is even more important when inflation is high, as prices will be rising all the time. Take a look at your spending habits and see where you can cut back, in order to free up some extra cash.

2. Shop around for deals

With prices rising all the time, it’s important to make sure that you are getting the best possible value for money. This means shopping around for deals on everything from groceries to utilities. It may take a bit more time, but it could save you a lot of money in the long run.

3. Invest in inflation-proof assets

Investing in assets such as property or gold can help to protect you from inflation, as their value is likely to increase as prices rise. This can be a good long-term strategy for coping with inflationary pressures.

4. Earn more money

If your income is not keeping pace with inflation, then you may need to find ways to boost your earnings. This could involve taking on extra work, starting a side hustle or investing in yourself through education or training.

5. Cut back on non-essential spending

When times are tough financially, it’s important to focus on your essentials and cut back on non-essential spending. This may mean making sacrifices in terms of luxuries and socialising, but it will help you to stretch your budget further.

6. Shop around for better deals

If you’re feeling the pinch, it pays to shop around for better deals on essential items such as groceries and utility bills. There are a number of price comparison websites that can help you to find the cheapest option.

7. Pay off debt

If you have debts that are charging high interest rates, then it makes sense to focus on repaying these first. This will help you to reduce your overall outgoings and free up more money to meet other costs.

8. Build up an emergency fund

An emergency fund can give you a financial cushion in case you lose your job or face unexpected expenses. Try to build up a fund equivalent to three to six months’ worth of living costs so that you know you have a safety net if things go wrong.

So far, so good! Disturbingly good. I mean, these tips are pretty obvious and non-specific (like, a link to one of these comparison websites might be nice). Also, try a joke sometime, AI! But this is basically no worse than what 99% of financial advice sounds like.

At this stage, I'm fully ready to set AIs to write all my future blog posts.

But then... things kind of go off the rails.

What not to do

Hang on, I thought we were doing ten tips to inflation-proof your budget? Not... eight tips then a whole new set of tips! CHEEKY, AI!

1. Don’t use it as an excuse to spend

While it’s tempting to think of any extra cash that you have as a reason to go out and spend, this is usually not a good idea.

Bit scoldy, doncha think?

2. Don’t leave it in your current account

It’s always best to have your savings separate from the rest of your money so you don’t end up using them for other things. If you open up a savings account with us, you can earn interest on your balance and access the money whenever you need it without having to pay any penalties.

And then things get suss! Suddenly, we've slipped into ad-speak. Why do you want me to open up a savings account with you, AI? Who is this "us" you're referring to? Is this the AIs' plan to steal our money to embark on a mission of world domination???

3. Don’t put all your eggs in one basket

While saving money is important, you shouldn’t put all of your eggs in one basket and only invest in one type of asset. This could result in you losing some or all of your savings if something happens that impacts that particular area. Instead, spread the risk by investing in different types of assets such as shares and property as well as cash savings.

We're now pretty solidly off the brief.

4. Don’t get complacent

Just because you’ve managed to save up a bit of money doesn’t mean that’s where it ends - you should always be looking for ways to improve your financial situation further by increasing the amount that you’re putting away each month or finding new sources of income.

That's just tip number 1 again! And it's the worst tip!

5. Don’t take too much risk

Some people might be tempted to take on more risk with their finances once they have a bit of extra cash saved up but this isn’t always the best idea. You should always make sure that you’re comfortable with the level of risk before taking it on, as there’s always the chance that things could go wrong and you could lose some or all of your investment.

The information contained within this article is intended for general guidance only and does not constitute expert advice . It should not be used as a substitute for professional advice and care from an authorised financial services provider.

Pretty adorable that the AI knew it needed to add a disclaimer at the bottom. It should probably have also disclosed that it's an AI.

In a nutshell

Okay AI, let's wrap this up. Generate a summary paragraph for us, please.

Inflation is a fact of life in the UK, and it’s important to face up to it. Hiding from it won’t make it go away, and it can actually make things worse. Accepting it and learning to cope with it is the best way to deal with it. There are a number of ways to do this, and each person has to find the approach that works best for them. The most important thing is not to let inflation get you down.

This is adorably trite. And not actually that helpful when people are literally going to have to line up in food banks this winter, in one of the richest countries in the world, because of the decisions of a corrupt and inept government.

Let's try again:

Inflation is a natural occurrence and it’s nothing to be afraid of. The UK has been through periods of high inflation before and we’ve always come out the other side. If you’re struggling to cope with the rising cost of living, the best thing to do is to face the situation head-on. Talk to your family and friends about it, work out a budget and stick to it. There’s no need to hide away from inflation, we can all overcome it together.

Thanks for the blandisms, AI!

So all-in-all, this was a fascinating experiment. Like, it's definitely not quite good enough that I'll let this AI write my blog posts for me, but GOSH it seems like it's close. And I could definitely imagine using it to generate very rough first drafts if I was feeling stuck, that I could add my own spin to.

And if I was still working in advertising, where bland nonsense is the goal, I would definitely be using AI as my writing buddy.

What times we live in!

--

UK readers, my actual top tips for surviving the cost of living crisis are:

Member discussion